I’ve written before about video game collecting and investing and its comparisons to electric train collecting and investing back in the 80’s. If you haven’t read that article than the jist of it was that individuals “investing” in those two hobbies rather than collecting for enjoyment, are/were actually creating a paradox where prices are inflated by their investment hoarding. With that said once they dump these items it causes a sudden drop in prices that leads to a negative impact on their planned investment scheme. Essentially, outside of any appreciative factors due to inflation, if applicable, an investor may end up with 0 to show.

Buying into a hobby or some other material item as an investment, isn’t new to the 80’s with electric trains or now days with retro video games. In the late-90’s and early 2000’s comic books were the investment fad, and that market crashed, and crashed hard, leaving many investors deeply in the red. In the 70’s the big investment trend was antique’s, mostly furniture and knick-knacks. I no doubt previous decades or half decades before had their own collectible fads as well. Of course what I’ve mentioned above are just some of the collectible fads, lets not forget Beanie Babies, and Baseball Cards along the way, among others.

I guess what always leaves me scratching my head is why anyone would decide a hobby, or some material item would be worth betting their monetary future on. If an item is bought as a hobby and some enjoyment is found in it, and later it’s sold at a profit, I get it. But, buying and hoarding video games, comic books, or even antique furniture with no intention of enjoying these items, but rather selling them at a perceived profit later makes no real sense in a fiduciary or common sense perspective. This is especially true when collectable investors are creating a false scarcity, that will blow up in their faces when they choose to sell.

The (Misconceived) Investment Strategy

Many are led astray by a story that seems to be told in every collectible investing fad. Let me know if you heard this one? It starts off with a guy going to a garage sale, or rummage sale or some sort of second hand store and finding some super-rare item being sold a mere fraction of it’s worth. In the world of electric trains it was a rare Lional GG-1 being sold for $2 at a garage sale, as the women selling was anxious to get rid of her deceased husband’s electric trains. This take on the story made it into Classic Toy Trains magazine in about 1987.

In the world of retro-gaming it’s a sealed copy of Chrono-Trigger or Earthbound bought from hapless empty-nesters looking to clear out their sons old video games that he left behind when he went to college and never came back for them. Essentially, these are the same stories with a few elements changed. Don’t get me wrong, finding true bargains happens, and even I’ve come across a few myself. But, the story of the find of the century, dates back to old 49er’s claiming to find 2 pound gold nuggets in a stream while trying to catch a fish to eat. Much as many an old mining prospector rushed to brook’s or creeks hoping to find their own nuggets by the pound, so do collectable investors rush into a market, raiding garage sales and resale stores alike buying anything they can as an “investment”.

As a video game collector and someone who’s knowledgeable about the hobby, I know the thought processes of many “investors” in video games. Often they appear in one of two camps, with different methodologies for how they are going to make money on their investments. These are the get rich quick investors, and the long-term hoarder investors

The get rich quick investors, look to cash in right away often over-valuing items, and placing them on eBay for unbelievable prices. It’s not uncommon to hear about outrageous game prices found on eBay through podcast’s like the old Retro Leagues, “Caveat Gamer” reviews, or even in those you read about in various Reddit postings. These are the sellers who place boxed copies of Pac-Man for the Atari 2600, on ebay for $10,000 when such items go for about $10. Or sell consoles such as the Sega Dreamcast without power cable’s, RCA cables, or controllers, and even unsure of working conditions for $1000, when the honest worth is maybe $25-$50 in such condition. Essentially, there’s no common sense to such pricing, just pure greed and hopefully looking to fleece someone by making them believe anything “retro-gaming” is worth big money. Spend five minutes on eBay looking for a favorite game or console and you too will find examples of this. Of course in previous collecting fads long before the electronic era, and marketplaces such as eBay, you’d often find such attempted fleecing taking place in antique shops. Such items like electric trains and antique furniture would often come in over-priced on shop floors, something true even today in many antique shops. Sometimes this would be on the part of the shop owner, but often it would be on the part of the actual owners, hoping to sell their investments, on consignment for many times what they paid for it.

The other investor tactic is to hoard, as I mentioned above. Shows such as Storage Wars, and American Pickers often feature spaces in which investors have hoarded certain items. For sellers who know what they’re doing, like the hosts of these programs, the goods are valued correctly and usually sell quickly. Often though with inexperienced investors/sellers, items are just gathered in hopes the market will hit some apogee to sell at, or that time will add value to the collection. This, like the other investor logic I’ve listed here, often tends to be a fallacious way of thinking.

The Downfall

Collectable investing often fails to take a lot of factors into account that are elementary to the rules of investing, and basic economics. Outside of the glaring opportunity costs of investing in collectables over more common investment instruments, there’s also the monetary cost that are involved in storing and maintaining said collectables to keep them in optimal resale condition. As any accountant for a retailer can tell you there’s nothing more painful financially than holding and maintaining inventory of resale, let alone doing it on a long term basis sometimes stretching into years or even decades. In addition those who have spent a significant sum of money on collectables to resell, will also need to purchase insurance to offset the losses of their material nestegg should a fire, robbery, or some natural disaster occur. This equals additional cost to the collectable investor, but many fail to account for this as well, or go without insurance risking everything.

Of course one of the biggest things collectible investors truly overlook is liquidity of the investments. Mainstream investments such as stocks, bonds, and commodities can usually be sold quickly through whatever brokerage firm your investments are with. This means the financial instrument to cash-in-hand process can in many circumstances take less than a week to happen. With collectibles the process is far from that simple, and the merchandise to cash-in-hand process can take a while as a marketplace to sell said items must be found.

Marketplaces such as eBay do help in this conversion process, but a collectable investor may find themselves competing with many others like themselves to sell their goods. Additionally, eBay and payment processors such as Paypal will assess fees for the items sale and collection of payment. In addition there are also shipping costs that may apply if the seller doesn’t charge a shipping fee. In the off-line world sellers can also look for retailers to buy their collectables directly, but many of these buyers will often undercut sellers on purchase price so that the retailer can still make a profit selling the items in their store. Lastly, there’s consignment in which the seller consigns their item to a store such as an antique shop to sell. These shops often charge rent to the seller for the space their items take up in the store, as well as percentage of the final sale price.

With all these factors in mind, to say the least the final sale process of disposing of a collectable investment, can often negate the profit potential of the investment.

Tax Implications

One last thing that collectable investors often fail to take into account is the tax implications of selling their collectables. If for instance an individual is selling enough collectables to be equivalent to “retirement savings”, then at some point the IRS may get involved in the process. If we were to give an example of a collectables investor selling a collection on eBay, and being paid through Paypal we have to keep in mind that both eBay and Paypal will file a 1099-MISC if sales go over a certain amount, which is around $20k. The $20k threshold was instituted recently following the growth of the “Gig” economy in which freelancers began to make large sums of money from online platforms, but that $20k threshold applies to everyone. Depending on the amount sold, sellers may be liable for taxes on their sales as high as 34% which represents a significant loss of money, especially to retirement savings.

More traditional retirement plans such as IRA’s and 401(k)’s would have given these investors the ability to “cash-out”, with practically no tax liability, and without the many pitfalls of collectables investing.

The Moral

When you get down to it, unless you’re in retail, purchasing material goods for resale at a later date isn’t a sound investment strategy. If you’re a collector, then collect for your own personal enjoyment. Whether it’s video games, electric trains, Beanie Babies, or even coins just buy what makes you happy and receive your dollars worth that way, without thoughts of making a long-term profit.

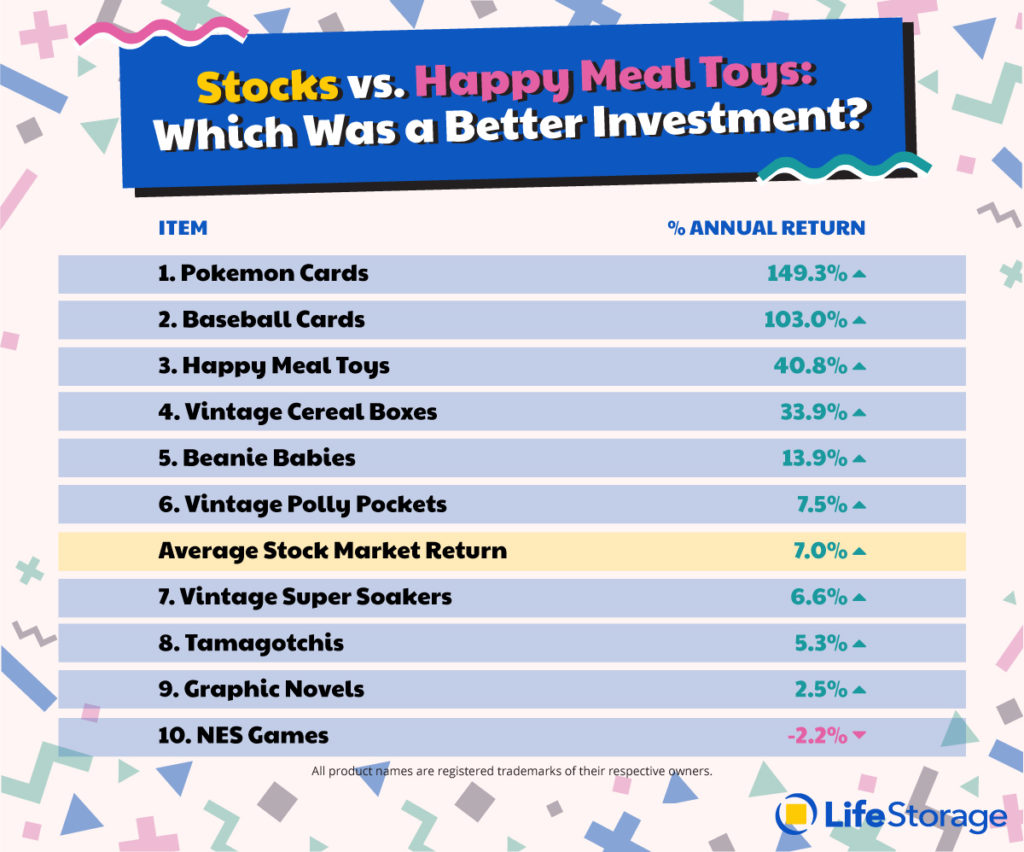

When it comes to money for long-term savings or retirement investment put that in more traditional instruments. Sure investing in a market that seems volatile, and that has recessions to deal with may seem off putting, and sure it can be hard to grasp the intangibility of stocks, and bonds over the control of on hand material collectibles. In the end though you will find that your wallet and retirement account thank you, as true growth, and inflation protection come from the monetary instruments of investing, and not from items collecting dust in your closet and at the mercy of those interested in ephemeral fads, that may not retain value.